Koran Lampu Hijau Kode Togel – Koran Lampu Hijau adalah sebuah media cetak harian yang terkenal di Indonesia. Di dalamnya terdapat rubrik yang berisi tentang berita dan prediksi nomor togel yang disebut dengan Kode Togel….

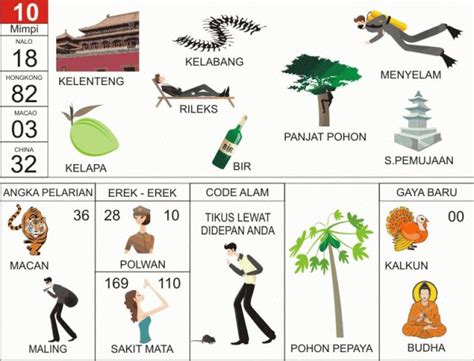

Mimpi Kelabang Togel – Mimpi adalah fenomena yang sangat menarik untuk dikaji. Salah satu mimpi yang sering muncul adalah tentang kelabang. Apa arti dari mimpi tentang kelabang dan bagaimana nomor togel yang berkaitan dengan mimpi…

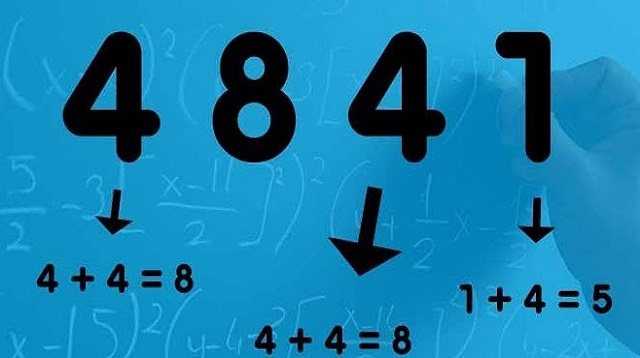

Apakah Anda sedang mencari informasi tentang pasang togel 10.000 4 angka dapat berapa Hongkong? Apakah Anda ingin mengetahui berapa hadiah menang togel 4 angka pasaran Hongkong jika memasang taruhan sebesar Rp 10.000? Jika iya, maka…